Gift Tax Threshold 2024. Gifting is one of the many ways to express love and. The 2024 gift tax limit is $18,000, up from $17,000 in 2023.

The gift tax imposes a tax on large gifts, preventing massive transfers of wealth without any tax implications. Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and.

For 2024, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts.

IRS Increases Gift and Estate Tax Thresholds for 2023, Visit the estate and gift taxes page for more comprehensive estate and gift tax information. For 2024, the annual gift tax limit is $18,000.

IRS Increases Annual Gift Tax Threshold for 2023 LCO Law, Essential filing tips for 2024. For 2024, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts.

Maximize Your Paycheck Understanding FICA Tax in 2024, Visit the estate and gift taxes page for more comprehensive estate and gift tax information. Earlier today, the white house released its fiscal year (fy) 2025 budget request to congress.

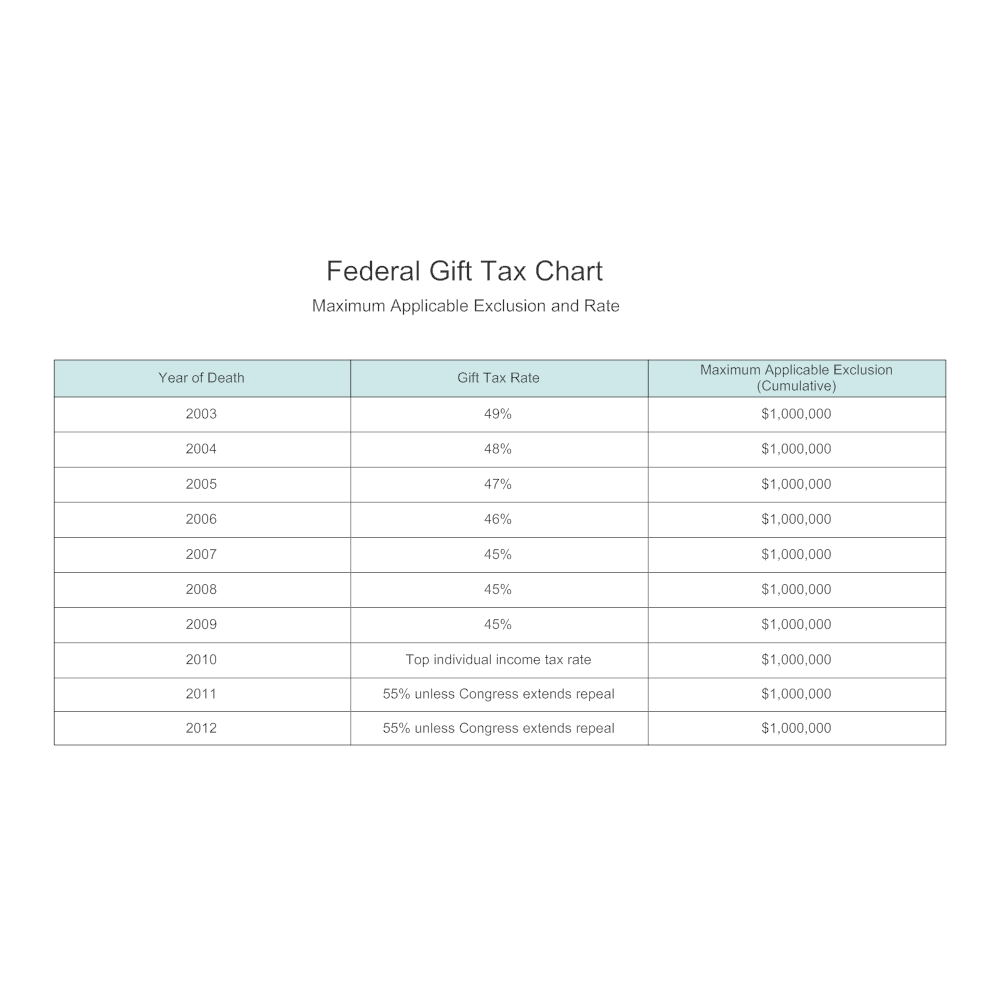

Federal Gift Tax Chart, Gifting is one of the many ways to express love and. Essential filing tips for 2024.

Gift Tax Limit 2022 Explanation, Exemptions, Calculation, How to Avoid It, The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient. Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2024 is $18,000 per giver per recipient.

Gift Tax Limit 2022 Calculation, Filing, and How to Avoid Gift Tax, This represents the maximum amount an individual can gift to another. The gift tax is intended.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Page last reviewed or updated: Earlier today, the white house released its fiscal year (fy) 2025 budget request to congress.

Understanding the Gift Tax Alloy Silverstein, Annual gift tax exclusion increase: (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.).

Key tax changes to be aware of from 1 April Blue Spire Accountants, Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and. Taxpayers typically only pay gift tax on the amounts that exceed the allotted lifetime exclusion, which was $12.92 million in 2023.

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, This means you can give up to $18,000 to as many people as you want in 2024 without. Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2024 is $18,000 per giver per recipient.

Further, the person giving gift to such a nr shall be liable to deducted tax at source (tds) at the highest rate applicable i.e.

Instead, a gift is taxed only after you exceed your lifetime estate and gift exemption, which in 2024 is $13.61 million for individuals and $27.22 million for married couples.